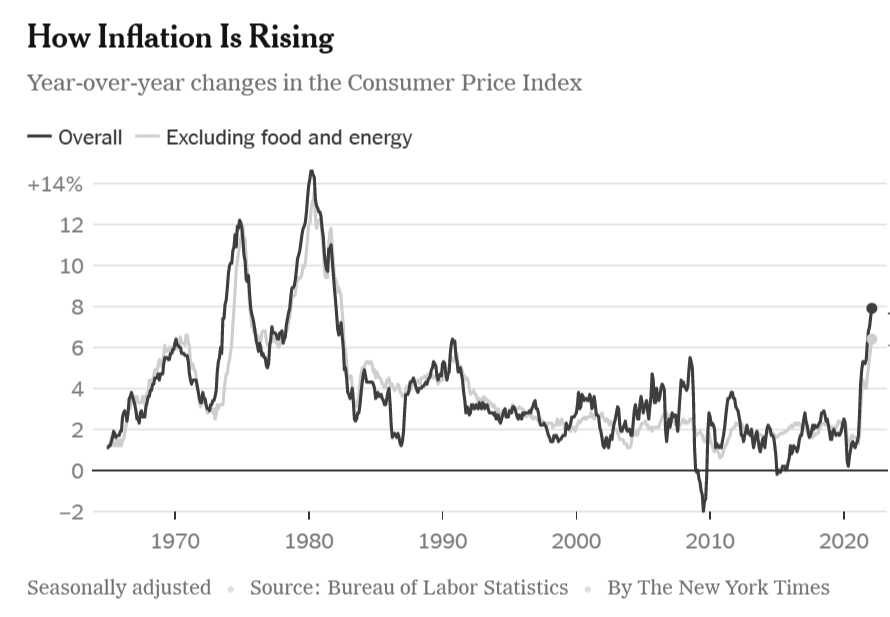

Did you ever think you’d hear the word “inflation” so much? Everyone’s been watching the index for its impact on the economy and we, of course, have been watching to see it’s impact on home prices, mortgage rates, and the overall residential housing market for you.

As you likely know, the pace of change has been staggering!!! The annual inflation rate increased from 1.7% to 7.9% in only 1 year from February 2021 to 2022. (It currently sits at ~5.0%, but still higher than during most of the last TWO decades.)

As we all know, the Federal Reserve has been trying to get inflation under control by aggressively increasing interest rates (short term rates). While the FED DOES NOT control mortgage rates (long term rates), there is inevitably some correlation.

As such, the average rate on a 30-year fixed loan increased from 2.98% to 7.08% in a matter of a few months last Summer and Fall. This drastic increase made it more difficult for an average buyer to qualify for a mortgage and made each home more expensive, particularly because there wasn’t a “crash” in prices.

That said, prices did dip marginally, but not enough to offset rates or the last 2.5 years of historical home appreciation. As we’ve noted before, we believe Q4 of 2022 was the “bottom” of the market in terms of home prices dipping and amount of competition.

Then, rates started to come down in January of 2023, and…what do you know?! As we predicted last year, the housing market started picking up again…we were back in multiple offer scenarios for well priced, turnkey properties that we’re well marketed…

Until…

Silicon Valley Bank (SVB) collapsed, followed by the wobble of the entire US banking system. Eek! This single event may have done more to slow down inflation than any FED efforts over the last entire year/+ of FED rate hikes. Any bank not classified as global systemically important (aka any bank that isn’t considered “too big to fail”) has been impacted by changes in the market, potentially leading to less lending and slower economic growth – this has had a cooling effect on inflation.

SO WHAT? What does this all mean for housing?

At the end of the day, the thing that we’re watching most closely right now is inventory (# of homes available to buy).

Despite all of the rigmarole discussed above – and, it isn’t over yet – the housing market and home prices have remained strong (not as strong as 2021, but still solid).

Why? Simply put, we have too few homes for sale compared to the amount of demand. Many homeowners who purchased (or re-financed) in the last few years may be “handcuffed” with their historically low mortgage rates and, therefore, are less willing to put their homes on the market. Not to mention…we’re decades behind with building new homes, and construction costs are soaring.

All of that said, the after-effects of the banking crisis may actually play a small role in housing inventory in our market. We haven’t seen it yet, but there is a chance that we see an increase in inventory in the months ahead (short term). Obviously, our local economies have large exposure to technology and banking, and some people just might have to sell.

And, then what? How does this play out over time?

Well, SVB had become a major player in the Bay Area housing market, providing sizable loans to developers, founders, and investors. In fact, at their collapse, SVB had $11B in total real estate loans – the large majority of this sum is attributed to commercial loans though, not residential, which is why we’ll be watching and tapping into our networks that are directly impacted (we know a handful of people who had SVB mortgages) by this to see how it all plays out. There is fear that developers will struggle to secure other/replacement financing for their projects, which may lead to a slowdown in new construction.

That’s the last thing we need if we want any hope of keeping prices within check as this will further perpetuate the lack of inventory we have…

To add on one more layer, we’re seeing some early signs of a slowing job market. Biden has been saying that our economy is strong and we won’t go into a recession because of the strong job market…Well, the March jobs report shows that hiring is now slowing and hours worked is down. First it is less hours, then it is less jobs. Think about it…if you extrapolate a 1/10 of an hour decrease in hours worked across the entire labor force, that’s the equivalent of 500,000 jobs.

Did SVB slow this or accelerate it? Time will tell…

And, in the immediate term, INVENTORY is the variable to continue to watch – as sustained demand has already proven to be keeping pricing levels roughly consistent. At the end of the day, what drives inventory? Well, it’s the things that typically do…people having babies, getting married, getting jobs in new locations, and everything else life brings….

P.S. There’s a lot of data to take in right now. But, don’t worry…we are always here to Blake-it-down for you. Just reach out!

P.P.S…In the meantime, here are a few bonus data sets for you…

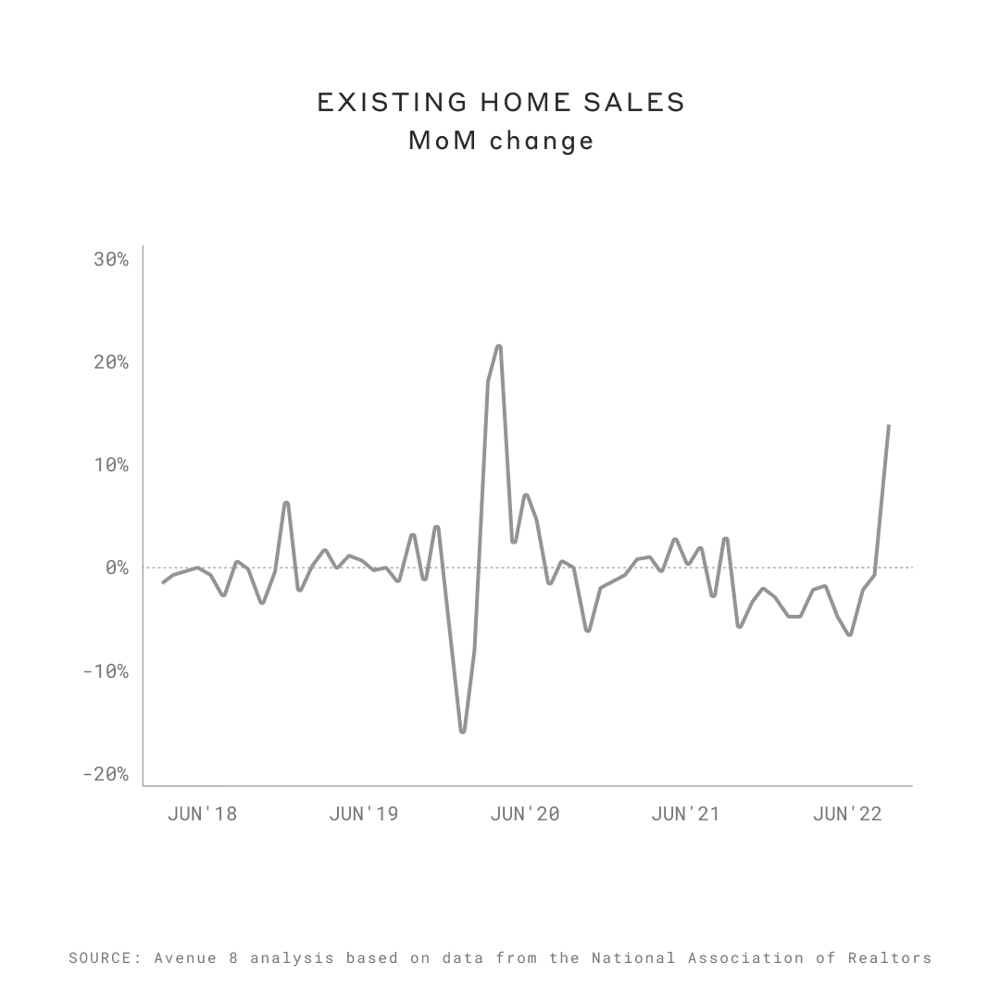

As temperatures begin to warm up, so does the national housing market

Nationally, sales of existing homes increased by almost 15% month-on-month in February 2023, representing the largest increase in more than 2.5 years. It was also the first time the statistic has been positive in 15 months, which could be a sign that the market is warming up again and buyers are becoming more active headed into the busier spring and summer months.

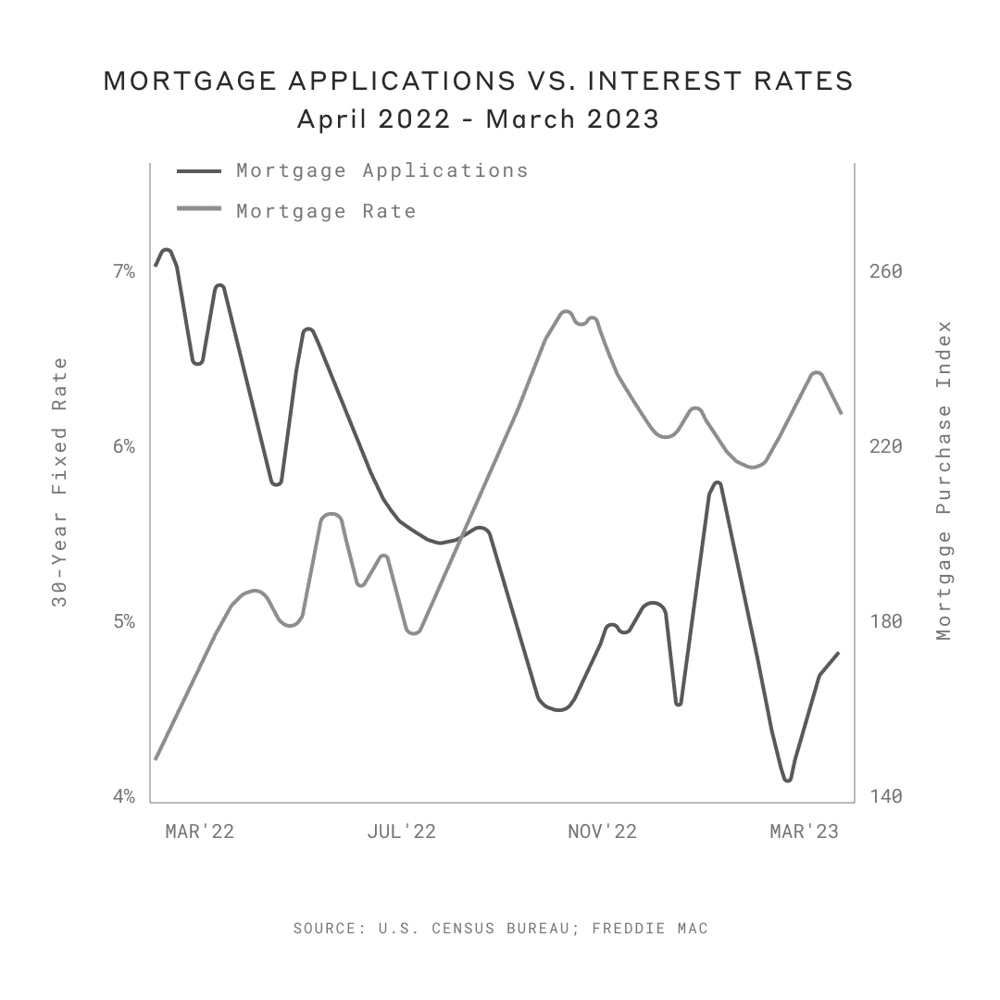

In the short term, the collapse of SVB may curb interest rates and encourage buyers once again

Many believe the collapse of Silicon Valley Bank and its aftermath led to a smaller rate increase from the Federal Reserve than planned. The result is generally lower mortgage rates, to which buyers have been extremely sensitive over the last year. The number of mortgage applications is inversely related to interest rates and immediately climbed up, which can indicate increased demand from buyers in the upcoming months.

— And, that’s a wrap! Catch you next time.