Well, as we all know – the world is crazy right now…there’s so much to talk about but, since I’m a realtor (duh!), I get asked EVERYWHERE I go, “So, what’s the deal?! How’s the real estate market really?” … I’ll focus on answering that today!

For those who like more detail, here it goes:

- What I’ve noticed is we have 2 kinds of clients:

Those who dwell on the past: focusing on the 2% rate that they didn’t get or the price of their home 2 years ago when they didn’t want to sell. They often use these words: “Should’ve, could’ve, would’ve.” But, that’s a dangerous game. - Then, there are those who use history to guide them, but who don’t focus only on the past. They focus on looking ahead and trying to make educated decisions about the future. These are the clients having a lot of success right now.

Ok, so you want to fall into bucket 2, but then, you wonder…what does the future look like?

We are currently diving deep into this question: What will we and our clients all be saying about today’s market when we look back on it in a year? Will the Media’s doom and gloom message be right (aka buying a home now is a terrible idea)? Or, will people realize that there really were some booming opportunities in Q4 2023?

To be able to answer that question…we need to dig into what we think will happen with rates and also home prices. Let’s try to light-up our crystal ball with some things that we know to be true + some basic math:

Rates

First, let’s start with the CPI. While the CPI numbers were a bit higher than expected last week, things are trending in the right direction, and the FED is finally beginning to acknowledge that.

What is also very important to note is that there is and will continue to be a lot of pressure on the FED to stop rate hikes. For one, the National Association of Realtors and Mortgage Bankers Association (two of the leading lobbyist groups in the US) have taken an aggressive tone with the FED as of late, calling for them to stop raising

Second, while the FED is supposed to be bi-partisan (like the Supreme Court), the reality is that there will be a lot of political pressure on them by the current administration to get rates down leading up to the 2024 election. This type of pressure is the case with every Presidential election, and they often succeed. While the FED doesn’t directly control mortgage rates, the short term rates and mortgage rates are correlated. So, if the FED stops raising interest rates and/or starts lowering them, we expect mortgage rates to stabilize and then fall.

What’s more, the Mortgage Bankers Association just recently shared their predictions, saying that they believe rates will be 5.8% in Q2 2024. This might be a little ambitious, but directionally correct.

Prices

People keep telling us that they’re waiting for prices to crash. But, here’s the thing: If we were going to see major price reductions, we would be seeing them RIGHT NOW, with rates at 25 year highs. Yes, prices have temporarily come down a bit (because of reduced demand). But, overall, the Bay Area is proving to still be a stable market to own real estate.

Plus… setting aside all of today’s economic news for a moment, the reality is that we still have a housing inventory crisis that could take decades, if not longer, to truly address. As long as inventory (supply) continues to be lower than demand, prices will continue to remain strong. So, I’m definitely not making any bets on prices crashing.

Competition

Simply put…when rates come down, competition will increase. Like we saw very clearly during the Pandemic, competition drives price. More competition = higher prices.

Well, what if more people sell and we have higher inventory? This will probably happen. But, those selling their home will also be in the market to buy their new home (thereby offsetting the increase in inventory). And…while higher inventory, on average, should help spread out some of that competition, that assumes that every home / location is equally desirable. We know that is not true. The hot homes in great locations will be even hotter next year.

What do we think? Here’s our best prediction: Rates will fall somewhat – probably in the high 5’s or low 6’s. That will be enough to stimulate more demand (read: competition). And, that will drive prices. The Bay Area will be a seller’s market (some parts are technically a slight buyer’s market right now) – fully non-contingent offers with bidding wars will be the norm once again.

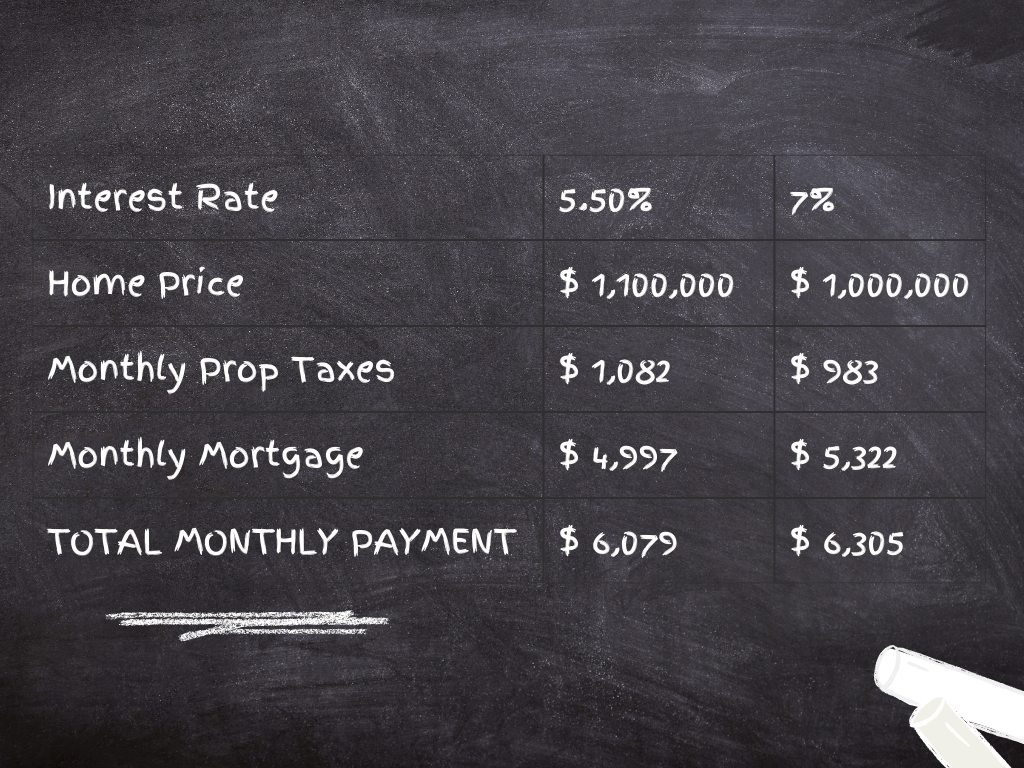

Let’s break that down with some math:

Let’s say you buy a home today at 7% for $1m. Later, rates drop to 5.5%. With lower rates, the competition heats up and that same home then sells for $1.1m with a bidding war.

Ok, so yes…in this scenario, it would be better to wait until rates come down. BUT…now, let’s look at the GAME CHANGER number: What if you buy now at $1m and then refinance your loan once rates dip. Then, your payment would be locked in at $5,525 … which is $553/month cheaper.

So, as we said in the beginning, the short-term “gloom” sets you up nicely for some long-term “boom.” 😉

By the Numbers

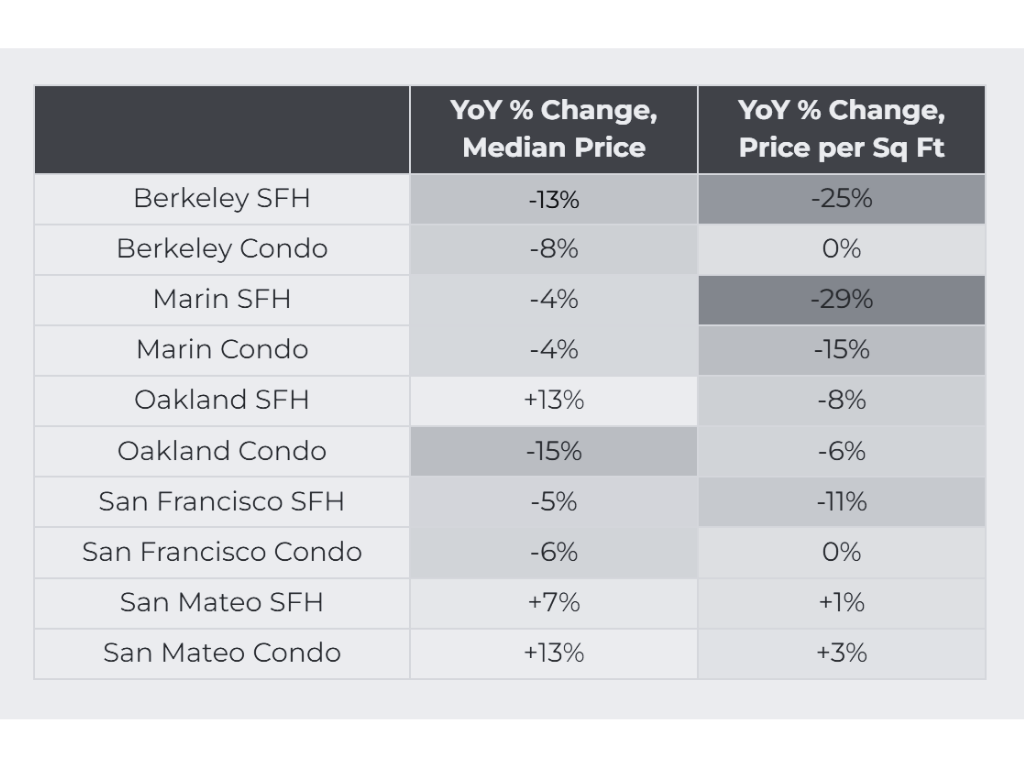

As noted previously, prices in most segments across the Bay are down somewhat, less than 10% at large. But, there might be some of the best opportunities when you look at how much condos in Marin have fallen (down 29% in median price; 15% price per sq ft) and also for single family homes in Berkeley (prices down 13%, 25% price per sq ft). San Mateo is the only area where prices for both condos and single family homes are up.

Generally, we saw the biggest dip in people holding back in Q4 2022. Throughout 2023, while YoY overall sales have been down, we’ve been seeing more and more people each month “get back on the horse” and make offers on homes. We expect this trend to continue.

A Selection of our Collective Wins

Won our buyers a single-family home in the Inner Sunset for a STEAL!! ($1,450,000 for a 3 bed / 2 bath home!!)

Sold a 2 bed / 2 bath condo OVER list price in 10 days for our sellers.

Listed a trophy property with unobstructed, panoramic views of Alcatraz and the Bay. (P.S. We got it prepped, photoed, and on the market in 5 days, just in time for Fleet Week)

Closed a single-family home in the Outer Sunset for $1m (OMG!!!) for our buyers!