If you’re wondering what the heck is going on with the housing market, you’re not alone! The answer is simple and it can be boiled down to two words: IT DEPENDS! Ok, we get that that is such an annoying answer, but hear us out: We have always talked a lot about micro-markets across the Bay Area, but never before has this been truer than right now.

I’m sure this isn’t surprising, but the housing market is incredibly local. So, go ahead and try to ignore those national media headlines, which really are only designed to get you to CLICK (how they make money) and they use FEAR to do this, hence all the scary headlines!

So, how is the market? Well, IT DEPENDS…there are so many nuances impacting each property it truly is a case-by-case answer. Here are all of the main factors we’re diving into for our clients…

- Location: What part of the Bay? What neighborhood? What street is it on? What block on that street and sometimes what building on that block?! Nuances to all these “location” aspects!

- What price point are we talking about? The $1mil market is behaving very different from the $4mil market…

- What type of property? (i.e., multi-family, condo, single family home, etc)

- What condition is the property in? Does it need repairs? What about updates to match today’s trends and styles?

There are some good opportunities out there, but you have to know where to look and what to look for on the buyside AND you have to be incredibly strategic on the sell side and make sure your positioning your property to the right buyer profile. (Pro tip: If you want suggestions to get you started, sign up for our bi-monthly “Best Buy” newsletter — our hand-selected featured opportunities across the areas that we serve across the Bay.)

Storytime

The other week, we had a client reach out to us, curious about the market. She told us…”You know, I’m just tired of the media. I’ve pretty much turned it off and now only rely on sources that I trust. I 100% trust you two, and I want your candid take on AI and the long term impacts on owning real estate.”

Well…that is exactly what we gave her…and a glass of wine! ;). She walked out of our time together with information that empowered her to continue making smart decisions for herself and her personal circumstances.

Here’s What We’re Seeing and Experiencing First Hand

As we all know there is some crazy volatility right now. First it was high inflation; then rising interest rates; then it was bank runs and closures; then it’s the debt ceiling; next will probably be a large inventory of bonds hitting the market so our government can raise cash to pay off debts; then it will (continue to) be the fight against inflation. And probably some more bank closures…followed by a recession and election season (too soon to bring this up?!)…

In short, things are changing by the day. Opportunities can pop up overnight — and then be gone in the blink of an eye. And, when the opportunities are so obvious to everyone — and blasted on the media — it could be too late.

What is coming?!

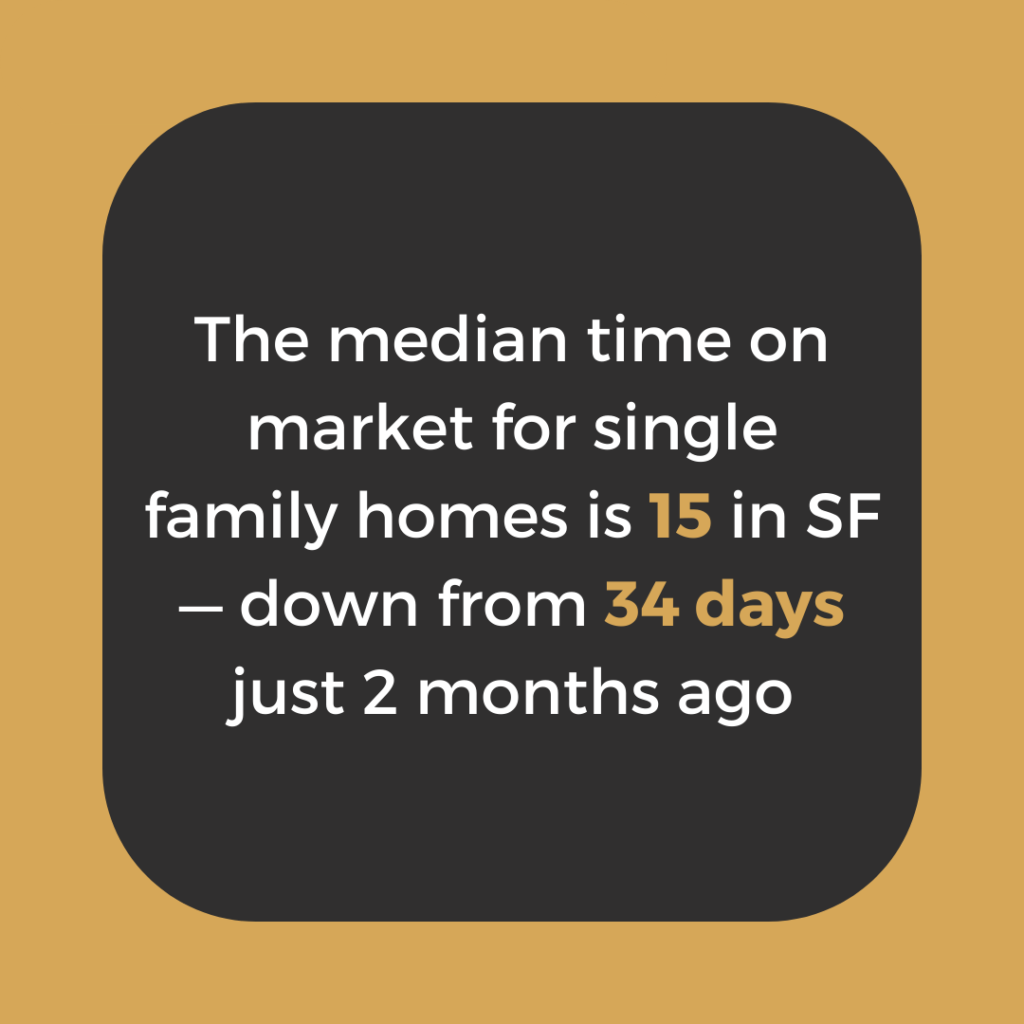

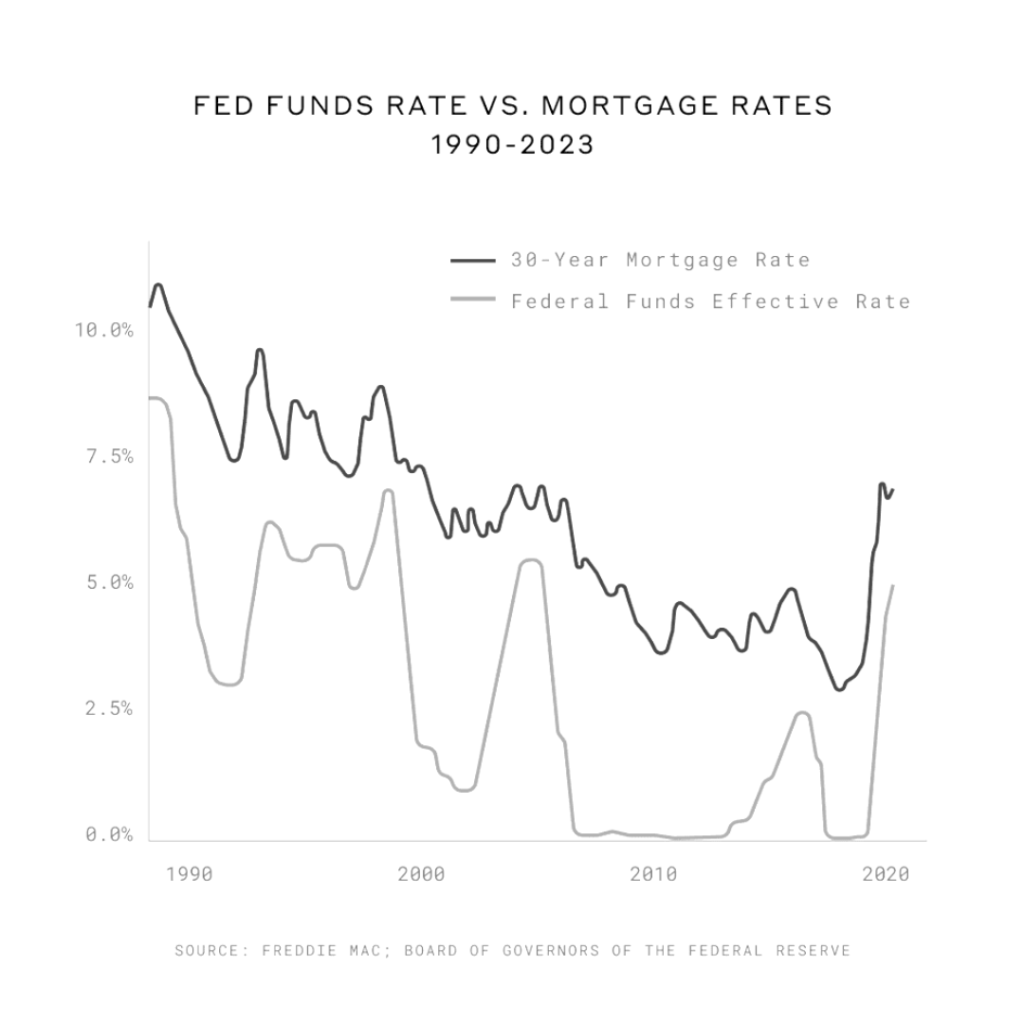

Right now, we have an inventory problem, driven mostly by rates. About 70% of existing home mortgages have a rate under 4%. Whereas, rates now are 2-3 percentage points higher. Why leave a 3% rate to roll into a 6.5% rate? The “golden handcuff” dilemma is real.

But, when will the dynamic shift? We, along with many other real estate experts and economists, believe we’ll see the shift when rates get around 5%. That will “unstick” this unique market. In fact, many experts, including the founder / CEO of Compass predict a “pandemic craze” in the housing market all over again when this moment comes. We’re seeing early signs that that period could be within the next 6-12 months, including qualitative measures like home builder confidence being up for the first time in many months and historical, quantitative measures like the graph below. It shows the correlation between FED rate Hike (which we believe to likely be over), and mortgage rates:

Warning: it might get a bit uglier before it gets better. Time will tell…

Our challenge to YOU

Remember the days of toilet paper hoarding?! Why did that happen? Well, the media instilled fear, and then we saw massive band-wagon behavior. Don’t be a band-wagon player. Think for yourself!

And, PLEASE don’t blindly trust the media / what you read! If you’re on this newsletter list, you’re smarter than that. Instead, reach out. Let’s talk about the facts. Let’s talk about your situation. And, we promise to give you candid, honest advice.

Our goal is simple, and it’s how we’ve built our entire business: Clients are not about 1 transaction; we want to make you clients (and friends!) for life. If now isn’t the right time for you to buy / sell…that’s ok. There will be a better time later.

So, is it your time? Here’s how to find out:

- Turn off the news.

- Reach out to chat, grab a coffee, or a glass of wine…

- and we’ll Blake-it-down for you!

Cheers!

Blakely