With 2022 in the rearview mirror, it’s time to focus on tackling 2023! So, what do we see coming, from a real estate perspective? Well, when we look into our crystal ball (read: do our homework, listen intently to the experts, study the data, and layer local insights and data on top of it all), here are our 5 predictions for 2023:

Let’s dive in to each:

There won’t be a housing bubble, because our market works off of supply and demand.

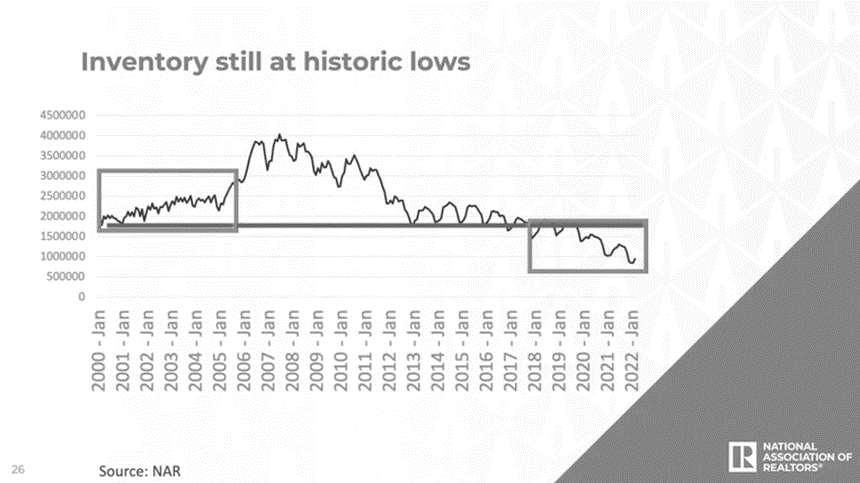

If there was going to be a bubble, inventory would need to skyrocket. There is a term in business called “downside sticky,” and this is what we’re seeing in the Bay Area real estate market now. Is there some fluctuation in prices, down from the crazy growth of the last 2 years? YES! But, if you’re waiting for prices to tank, think again. Five years ago we had ~1.4M units for sale in the US. (Btw…that was considered a “seller’s market” – aka sellers maintained more leverage than buyers.) Now, we have about half of that. And, the Bay Area is even more supply constrained!

Said again, to see another 2008 / housing bubble, we’d need a huge number of homes flooding the market. However…92% of all homes in the US (that have a mortgage) have a rate under 5%. What’s more, about 30M homes are sitting on mortgage rates under 3%!! And…on average, people have $300k of equity in their homes – aka a very different situation than 2008. (Not convinced? See even more reasons why this isn’t 2008 here.)

So, people have lower mortgages and higher equity in their homes – read: people have options. If they need to move for personal reasons (i.e., divorce, change of job, expanding family), they very well may lease their existing home – with their low rates, high rents, and the continued tax benefits of owning real estate, many will be looking at generating cash flow. If they do decide to sell, for most, it will NOT be how much will you lose, but they just won’t make as much as they would have in 2021.

Ok…sure…but, what if lots of people decide to let go of their mortgages and sell their homes? Or, what if they lose their job and want to access the cash in their home? Then, will we be in a “bubble” / crash?

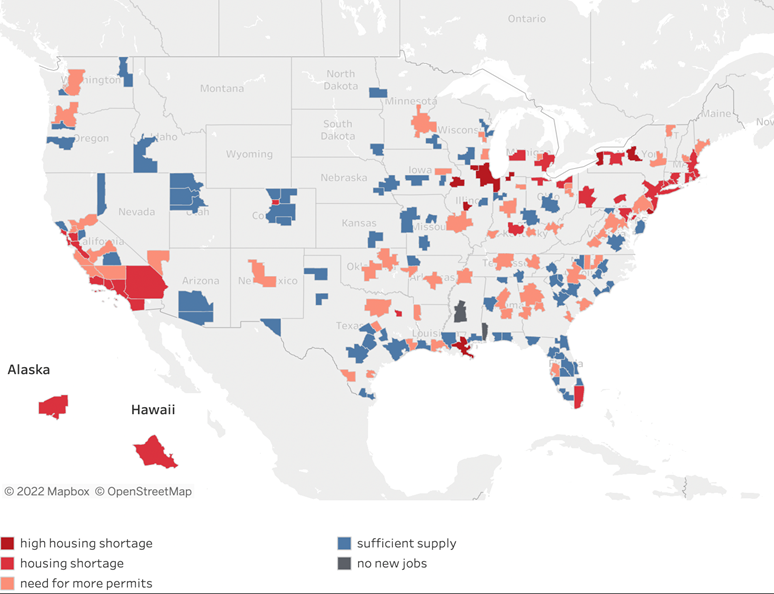

No, and here’s why: California has the largest deficit of homes in the country (compared to how many we need for our population) – despite the “mass exodus,” we’re short 980,000 units.

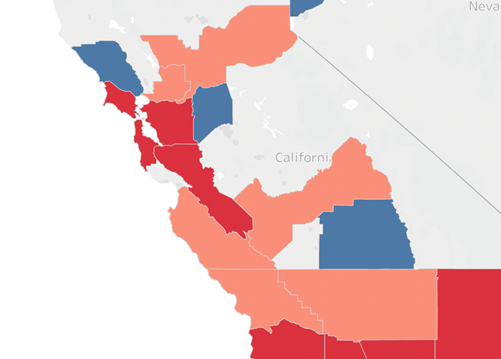

Not to mention…we aren’t catching up any time soon: When you look at new jobs in a location, relative to the number of new construction permits, most of the Bay Area is about as behind as it gets:

Here’s the map zoomed of the Bay Area:

So, we have people who aren’t incentivized to give up their mortgages, AND we are WAY behind on building – not a good combination.

BUT…the good news (kinda) is that the government is stepping in. In June, Governor Newsom allocated $400M to incentivize conversions of underutilized commercial buildings into housing over the next two years. Good! However, while it’s a nice idea in practice, it’s much harder in reality – this conversion can require sewer systems to be redesigned, bathrooms to be added to interior spaces, and local permitting and planning offices to agree on decisions quickly. Ha! (So, we’re kinda back to the original supply problem.)

Ok, last thing re: inventory that some people have been asking me: But, won’t there be a ton of foreclosures hitting, as we move out of the pandemic foreclosure moratorium? Again, the answer is: NO. The moratorium is now over, but loans in default right now in the US are still less than ½%. (Servicers generally plan for / expect defaults in their portfolios to go up to about ~1%.) Also, ever since 2010, we have seen fewer and fewer foreclosures each year in the US. So, this brings us back to how this is a very different context than 2008 – Lending standards have dramatically changed since then, and homeowners are stronger now – they have options (and may not choose to sell).

Of course, supply is just one side of it. Yes, we have limited supply, but that only matters if we have at least as much (or more) demand. Well, we’ve got news for you: Demand will continue to increase. Why? Millennials are hitting their prime home-buying years, and they are comin’ in hot. The largest proportion of homebuyers in 2022 (~43%) were millennials. As of November 2022, the average first time home buyer age was 36 years old. Millennials are currently between 26 – 41 years old – aka prime buying years.

We will NOT go into a buyer’s market in the Bay Area.

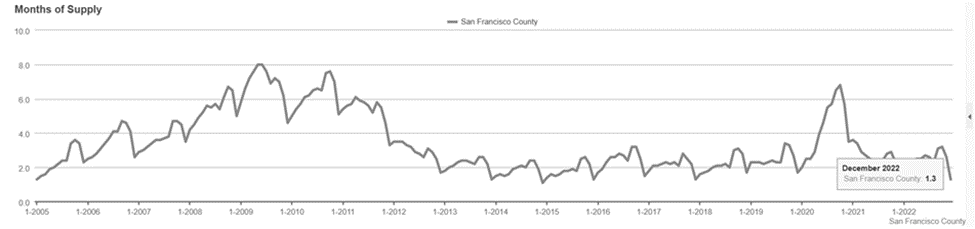

To start, what is a “buyer’s market?” We calculate this in “months of inventory” – if nothing else were to hit the market, how many months would it take to sell what we have? A buyer’s market is when we have 6/+ months of inventory. In December of 2022, SF (as an example) was hovering around 1.3 months. However, this is a traditionally slow month (because of the holidays). November 2022 was 2.9 months. We believe we’ll see a more balanced market during much of 2023, around 3-4 months of inventory (aka a slight seller’s market).

That means that while prices won’t be tanking, sellers will have to be more realistic and accommodating when selling their property. For example, they may have to actually fix things that are broken, allow contingencies and then potentially negotiate about issues with the home, or accept a slightly longer closing timeline.

There is one big caveat to this – not all markets are created equal. In the pandemic, the I-buyers (i.e., Zillow Offers, Opendoor) were buying up homes like hot cakes in “fringe” markets, where they believed they could buy a good amount of inventory, get good rent, and benefit from fast appreciation. However, most of those institutions have run out of cash, and, therefore, those markets have corrected fast (read: will be hit the hardest).

Mortgage rates will come down in 2023, thereby sparking more demand than we see now.

We have never, ever seen a year where mortgage rates doubled like they did in 2022 – that was, undeniably, scary and caused people to pause and think. But, 2023 will be a “year of normalizing” – back to reality.

We’ve already blogged about why we think rates will be down a few times – with lots of data and historical charts. (See here, here and a little bonus here.) To recap: we believe that history generally repeats itself and, as such – We anticipate a potential (shallow) recession, during which we should see rates come down and housing demand to rise.

Spoiler alert! Where do we think rates will be? Looking into our crystal ball, we believe jumbo loans* will be in the 4’s or potentially low 5’s. Keep in mind that the average 30 Year Mortgage Rate in the US from 1971 to 2022 was 7.76%, so rates in the 4’s are really great!

*Jumbo loans, the majority of loans in the Bay Area, are loans larger than ~$1,070,000 (exact number depends on the county you’re buying in.

Affordability will continue to be a major issue, and we’ll see the government taking a more active role.

Governments will be taking a stronger role in housing, but, unfortunately, affordability will be a problem we’ll be fighting for decades. We believe that housing starts (aka the number of new homes starting construction) will come down through mid-2023, until rates start to come back down. But, this isn’t good – as mentioned earlier, we’re already way behind; there’s no time to push pause! So, governments will start stepping in and offering incentives to developers to build housing.

Cities that delay meeting the state-mandated housing plan deadlines will face lawsuits and/or fines. In fact, in 2022, the Californians for Homeownership, a nonprofit organization that is sponsored by the California Association of Realtors, filed lawsuits in Los Angeles and Orange County superior court against 6 cities. San Francisco was not part of that, but it is definitely under scrutiny as well. While this is good for affordability, as we mentioned before, it’s not always super simple, and this will take years, if not decades to get under control.

One thing to note for the more immediate short term – Because of (in large part) this affordability issue, California homeownership rates have plunged to the lowest level since the 1940s! Homeownership is a good thing for cities for many financial and non-financial reasons (see our post on “6 Hidden Benefits of Homeownership” here). So, expect to see some programs that offer relief to first time homebuyers, with the goal of increasing homeownership rates across California.

Employers will have more leverage than in past years, so commuting will become part of people’s home search again.

We’ve all seen the headlines, and some have felt it firsthand – the tech layoffs are real. Twitter, Facebook, Amazon… Given current market conditions – which are quite different from the environment that helped many tech companies SOAR during the pandemic – employers are focusing on the bottom line. That means fewer employees (the biggest line item of any company’s budget), less hiring, and less spending for the sake of “growth at all costs.”

Tightening spending also means doing more with less and focusing on productivity. So, as this much-discussed recession looms over us and companies go from growth mode to survival mode, we believe that workers will be called to return to work (sorta). Not full time — but at least a couple days a week.

Now, I do believe that employers will keep some WFH options to retain top talent (as long as they keep performing!). But, 2023 will certainly be more of an employer’s market than we’ve seen in the last several years. AKA employers will have more power to demand workers to have some in-person presence.

In the world of “BC” (Before Covid), commute time and/or proximity to a tech shuttle bus was a large factor in the home search. That was completely thrown out the window during Covid (for the most part). With a more hybrid working arrangement, I anticipate it coming back into the conversation, dictating where people buy homes – to some degree.

So, that’s what we’ve got! Of course, we’ll be constantly tracking all of these to see if there are any signals of change in direction. At the end of the day, though, there is no such thing as “timing the market”: As the saying goes, if you try to catch a falling knife, you’ll probably just end up cutting your hand.

Considering buying or selling? Weigh your options, understand your personal situation and goals, and make the decision that is right for you! We’re always here to have a 1:1 strategic conversation with you about all of your housing needs!

Happy New Year!

Cheers,

Blakely