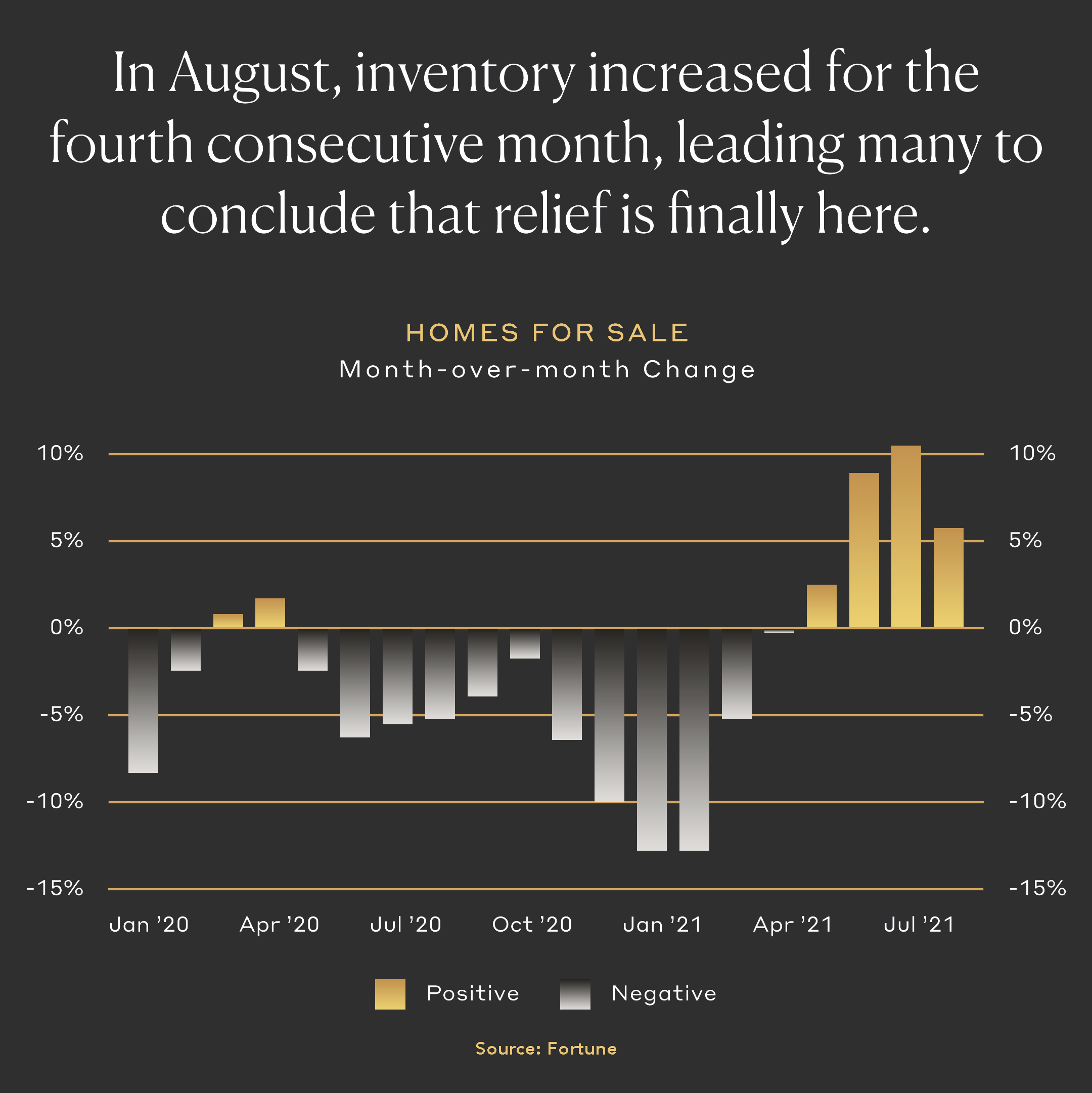

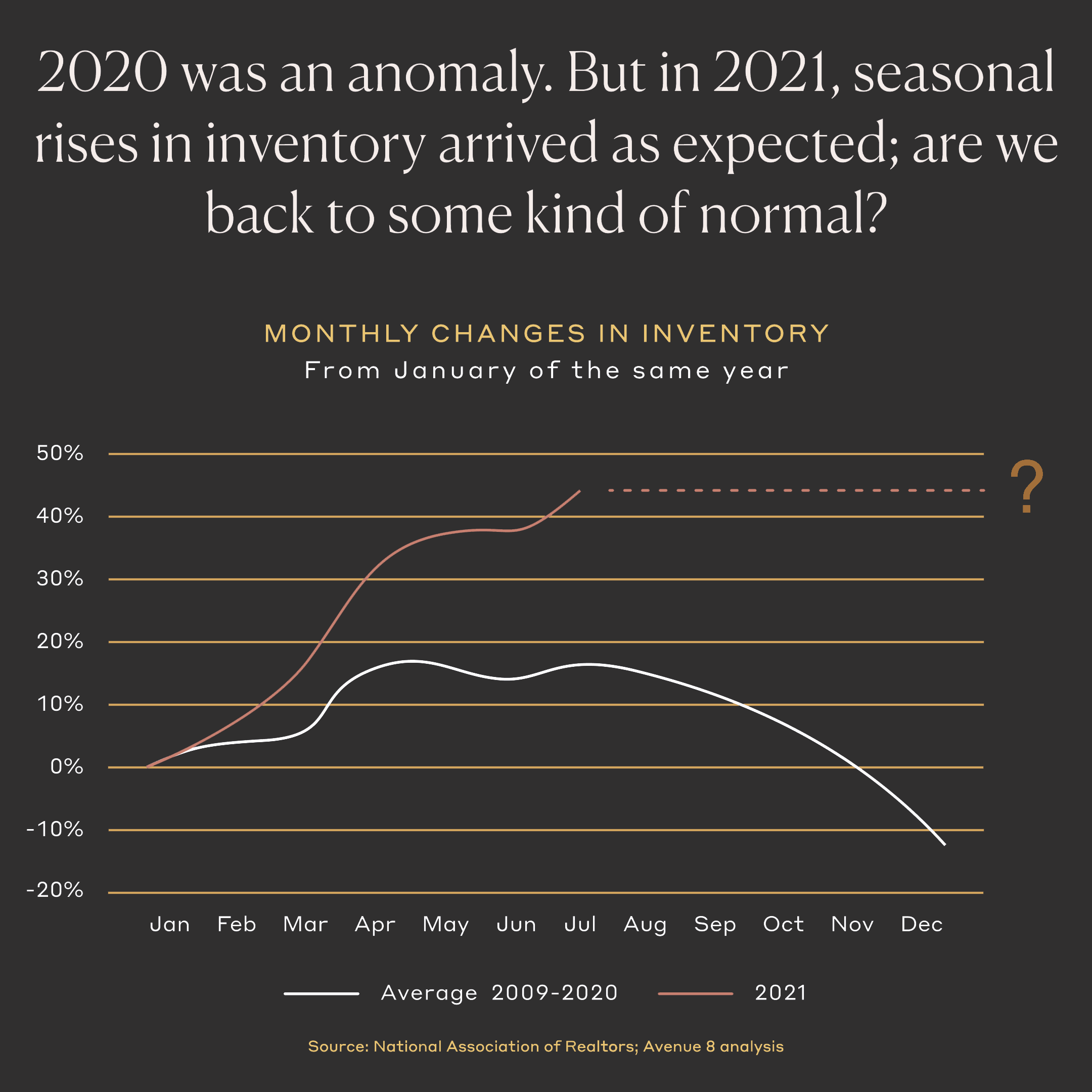

2020 was an anomaly (no sh*t!), but in 2021, we’ve seen the typical seasonal rises in inventory. The signs are showing us that things are somewhat normalizing.

The tl;dr is: For the most part, inventory is UP, and people are in shock. We’re seeing some sellers who are being overly greedy (and who need a reality check), and, at the same time, many buyers who are being overly picky. The result? Some really great opportunities for buyers who are decisive and realistic.

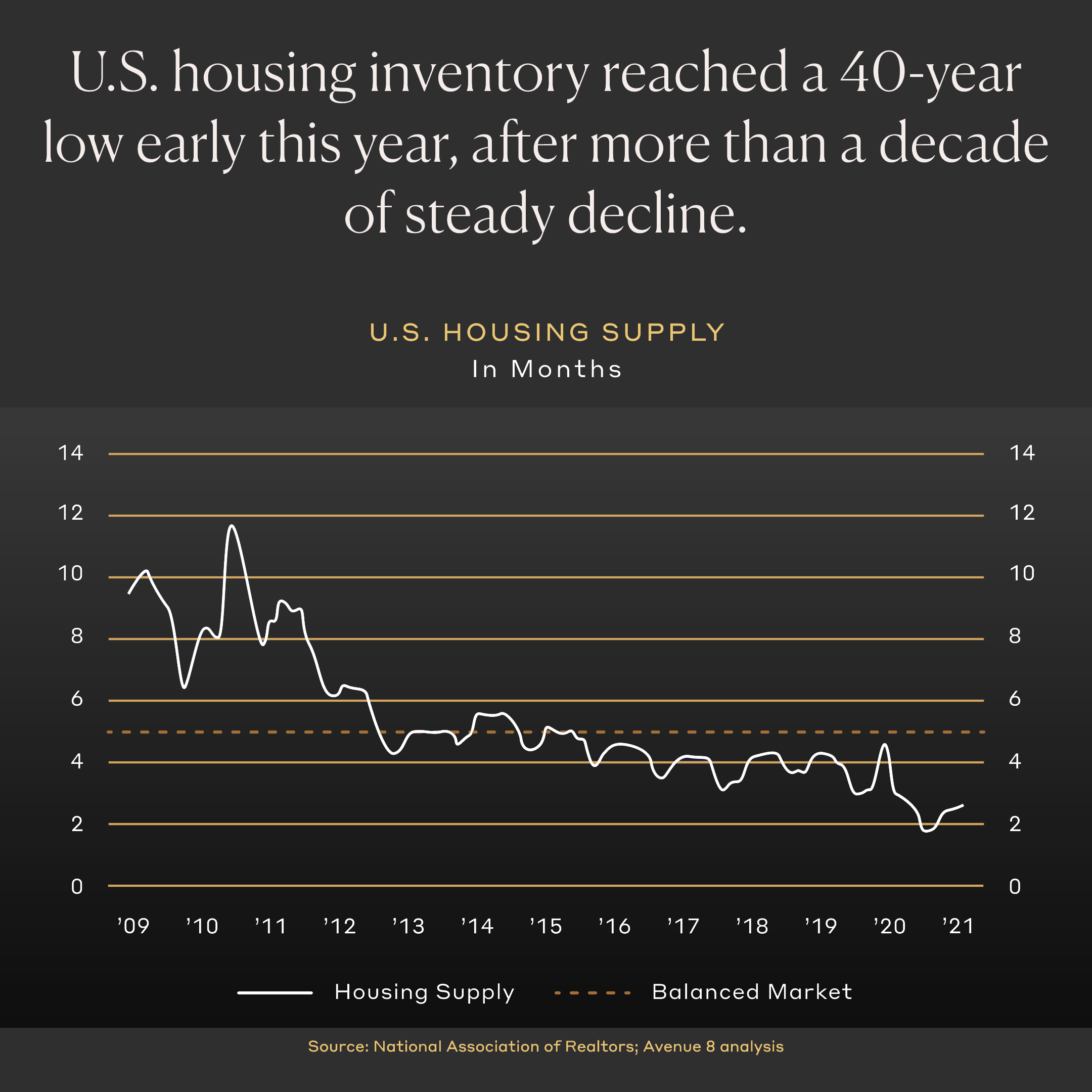

For those data nerds out there, here is more context: It’s no surprise… The lack of inventory during much of the pandemic drove much of the growth in home prices. In fact, US housing inventory reached a 40-year low earlier this year. There had been no material increases in inventory since March 2020. Then, this summer, things started to change… the number of homes for sale has increased over the last 4 consecutive months.

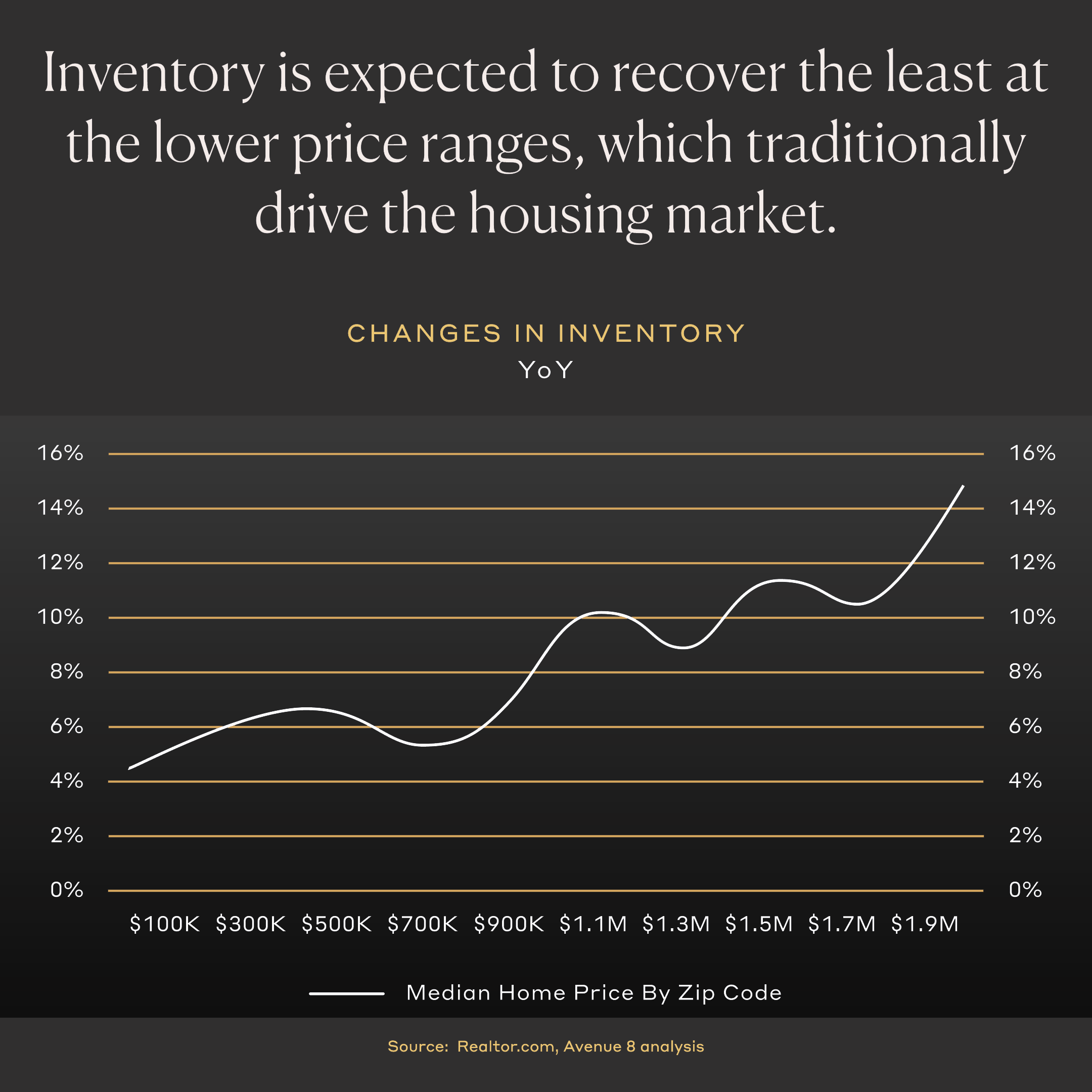

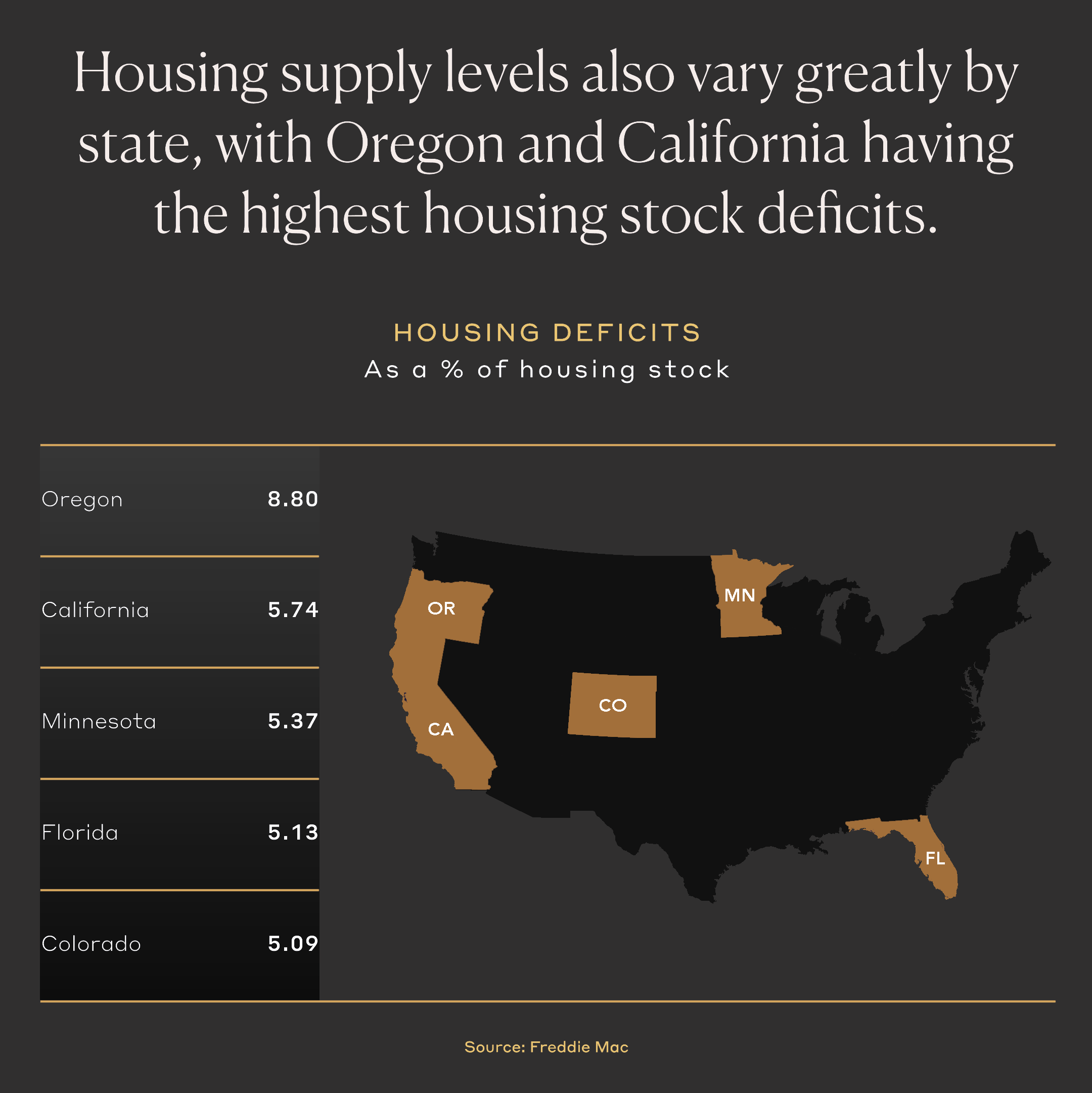

Some believe that inventory will increase even more (as much as 11% nationally) as we hit the end of the federal mortgage forbearance program at the end of the year. That said, I always talk about “micro-markets,” and, in that vein, inventory hasn’t increased by the same margin across the board or by the same margin across different parts of the US. In the Bay Area, with the solid home price appreciation that we have, the strengths of jobs here, and our average price points in general, we don’t anticipate that the end of the forbearance program will materially impact inventory in the Bay. In fact, while the media loves to say that everyone is fleeing CA, we still have one of the largest housing deficits in the US (~6%). That brings in its own challenges with affordability, but it also means that those who are homeowners have a good amount of protection in their asset!

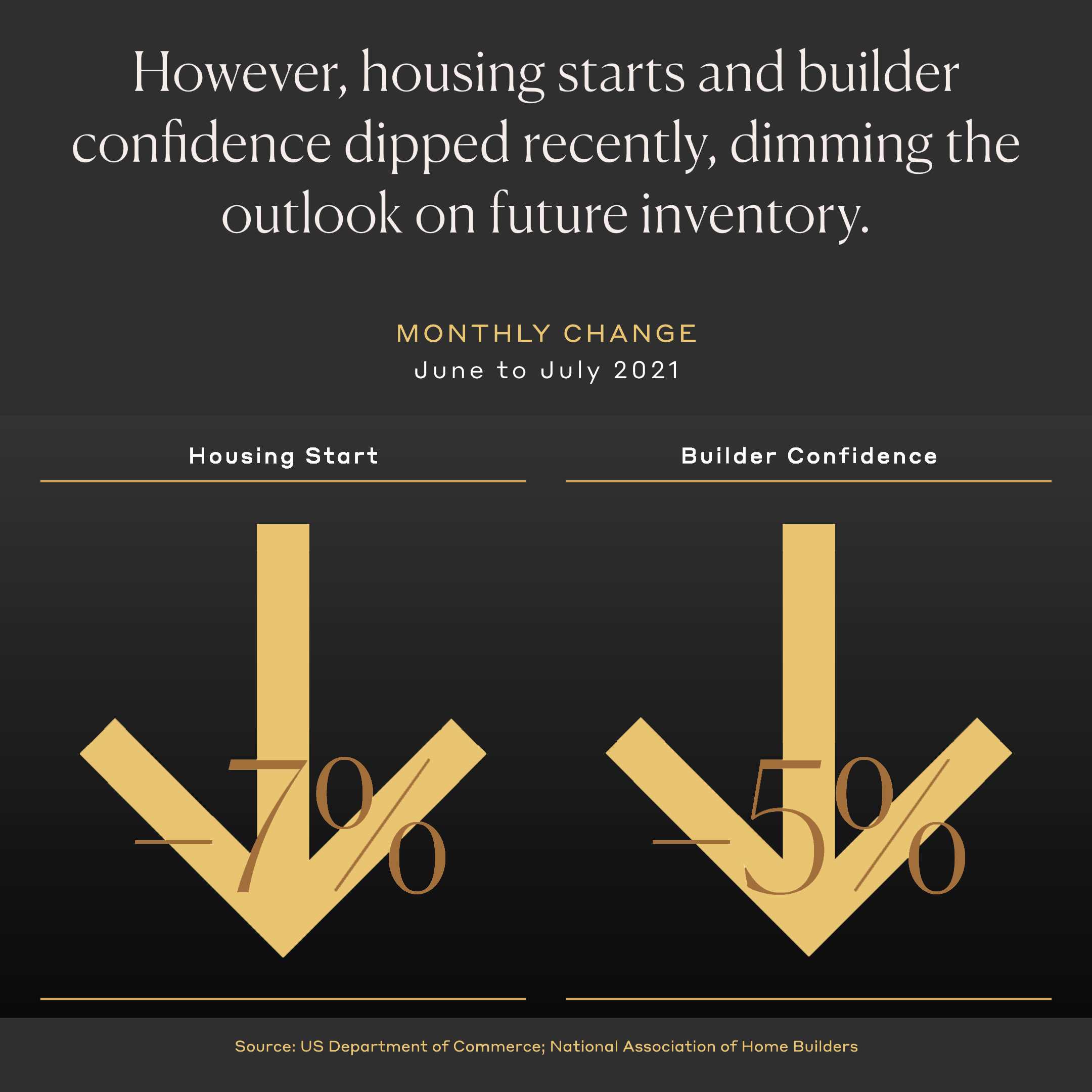

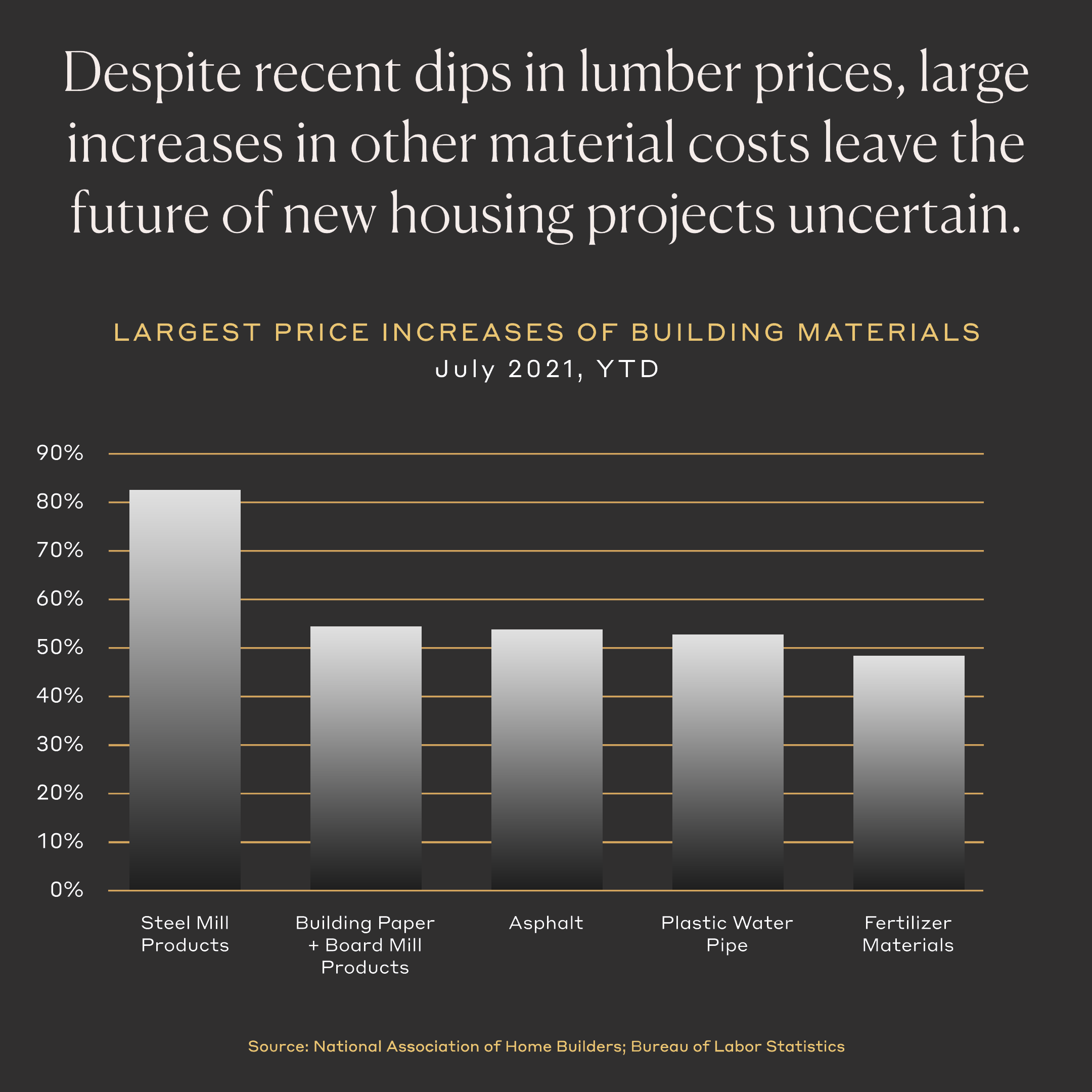

One other note that I want to call out is that, for the first time in over a year, builder confidence decreased a bit, indicating that housing starts (a.k.a. our future inventory) could dip, thereby leading to future inventory issues. This is mostly due to insanely increased building costs and labor shortages. In fact, while lumbar costs have come down some, 5 product categories have increased in price by ~40%!

In short… we are higher in inventory now than we usually are at this time of year (that’s an opportunity for people who are looking!) On the other hand, we’re entering the time of year where inventory typically dips off pretty quickly, so the window may narrow quickly. Time will tell!, and I’ll be watching 🙂

As always, I’m happy to chat more! Hit me up.

Cheers,

Blakely